Bad Credit

About Mortgage With Bad Credit Score

Bad credit score mortgage lenders rely heavily on the quality of your property and the area. They may not lend in small towns under 50-100,000 people depending on location, run down neighborhoods with nearby commercial areas and property values under about $250,000. No industrial central Hamilton areas. How much money you’ll get depends on your credit, income and property. In rural areas with well and septic, the home mortgage for bad credit lenders limit is 65% of property value.

How Does A Bad Credit Mortgage Approval Work?

The main focus is on the equity and marketability of your property. Mortgage loans bad credit are based on common sense lending where you can show that you have enough equity in your real estate and can show cash flow to be able to afford the mortgage payments.

We can help with bad credit loans in Niagara. Yes, we can give you, home mortgage refinance solutions and home mortgage help throughout Ontario.

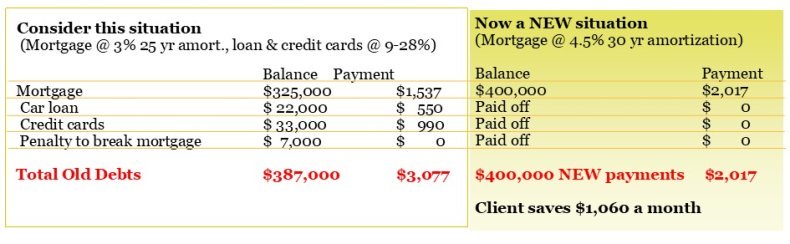

Many of our clients experience setbacks in their lives and have too much high payment debt that is hurting their cash flow and a way of life. With the high interest rates charged on their credit cards, often in the range of 19% to 28%, they have difficulty making minimum monthly payments. Usually, never paying down any principal owing.

There are many reasons good people get in over their heads financially — loss of job, business failure, divorce, serious illness, car accidents, bad spending habits, bankruptcy and more.

If this is you, don’t worry, you are not alone. It’s life — alternative mortgage refinance can help end credit card debt and improve your situation. With top debt consolidation loans and debt help you’ll get a fresh start.

8 Reasons To Call Us For Bad Credit Equity Loans

- If you have enough equity in your real estate, the property is marketable and you can afford the monthly payments — we’ll do our best to get your mortgage with bad credit approved, promise!

- We’ll give you the respect you deserve regardless of your credit.

- We will not judge you but help you rebuild financially.

- You’ll get the best long term mortgage solutions to financial recovery.

- You’ll get quick turnaround and practical advice.

- We’ll help you to repair your credit.

- We’ll walk you through the mortgage application process from start to successful closing.

- And, you’ll get fast and friendly service.

Second Mortgage Loans

A second mortgage is an additional loan taken out on a property that is already mortgaged. For the lender, this is more risky than the first mortgage, because they are in second position on your property’s title. If the homeowner defaulted on their payments and the property was taken into possession, the lender in first position would always be paid out first, whereas the lender in second position runs a higher risk of not being paid out in full. To compensate for this additional risk, mortgage rates for second mortgages are always higher than for principal mortgages.

For individuals with an existing mortgage, who have good credit and more than 20% equity in their homes, the most affordable second mortgages will be in the form of a home equity line of credit . However, if the homeowner has weaker credit and/or little equity in their property, a second mortgage through a trust company or private lender would be required.

Why Would I Need A Second Mortgage And How Do I Qualify?

A second mortgage can be a great way for homeowners to consolidate debt. Though second mortgages often carry higher interest rates than first mortgages, these rates are still often lower than high interest credit cards, car lease payments or unsecured lines of credit.

If you use a second mortgage to consolidate debt and help you meet other financial commitments on time, this can improve you credit score and allow you to qualify for a mortgage with a prime lender sooner.

In order to qualify for a second mortgage in second position, lenders will look at four areas:

- Equity. The more equity you have available, the higher your chances of qualifying for a second mortgage will be. If you are purchasing a house, a larger down payment also decreases the risk that a lender takes on. Regular payments towards utilities, telecommunications, insurance, etc, and/or confirmation letter from service provider(s).

- Income. Lenders want to verify that you have a dependable source of income, to ensure that you can make payments.

- Credit score. The higher your credit score, the lower your interest rates.

- Property. Because other factors are risky (i.e. your credit score), lenders need to secure their investment in case you are unable to keep up with mortgage payments.

Meet Virtually

To Discuss Your Mortgage

Help us stop the spread of COVID-19 by completing your mortgage, virtually, from the comfort of your home and earn up to a $200 mystery gift on the successful closing of your mortgage.

For in-person advice in as little as 24 hours.

To complete your secured on-line mortgage application